I. Summary

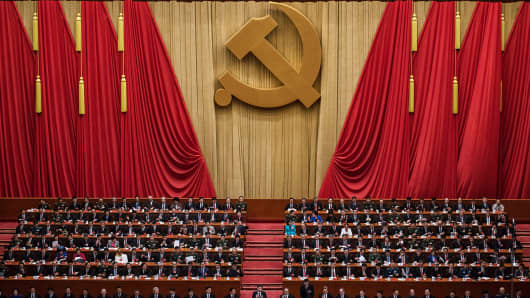

When President Xi Jinping of the People’s Republic of China first unveiled the One Belt and One Road Initiative (OBOR) during the second half of 2015, the world reacted with much fanfare. While the OBOR was in hindsight a natural extension of China’s increasingly external-oriented economic growth and development policies, the official announcement of the project, its ambitions, and the costs they entail sent shockwaves throughout the international community. Two years later, the hype surrounding the project has died down amid the multiple problems and obstacles it has encountered. This has led economists such as George Friedman to declare that the OBOR is “doomed to fail.” Such sentiments, however, may soon prove to be unfounded. The recent Belt and Road Forum and the CCP’s surprise inclusion of the OBOR into China’s constitution highlight the resolve of the CCP and its president in seeking out the successful execution of the project. In light of China’s explicit statement of intent regarding the OBOR, policymakers and citizens of the world would benefit from understanding the nature and characteristics of the OBOR and the implications it has for the international arena.

Indeed, the OBOR represents much more than an emerging country’s desire to achieve economic growth. China’s OBOR initiative is a monumental economic and geopolitical project designed not just to enhance China’s regional economic presence but also to lay down the foundations for its ambitions of taking on a more central role in world affairs.

Explaining the One Belt and One Road Initiative and its Components

The Silk Road Economic Belt and the 21st-century Maritime Silk Road, better known as the One Belt and One Road Initiative (OBOR), are an economic development project conceived by Xi Jinping that seeks to foster closer economic cooperation between China and its regional neighbors by way of extensive infrastructural investments, trade deals, and international institutions. At the most basic level, it is comprised of two mediums: the overland Silk Road Economic Belt (SREB) and the oceangoing Maritime Silk Road (MSR). The SREB is designed to connect China with the rest of Asia, Europe, and the Middle East via logistic chains and economic corridors. Meanwhile, the MSR seeks to build efficient transport routes between major international ports and will span from “China’s east coast to Europe through the South China Sea and the Indian Ocean, and east into the South Pacific.”A. Infrastructural Investments

At the heart of the OBOR are China’s massive regional infrastructural investments. These infrastructure projects, which take place throughout Eurasia and form the backbone of China’s economic vision, mainly take the form of investments in transportation and energy systems. For example, the New Eurasian Land Bridge “runs from the port of Lianyungang in Jiangsu province, all the way to Rotterdam in Western Europe” and will be connected by a system of international freight trains. Another prominent transportation route in the making, the China-Mongolia-Russia Corridor, involves high-speed railroad links. In addition to physical capital investments, China is also negotiating with customs departments in various countries to streamline custom costs and duties.

B. Scope and Scale

Touted as the “world’s most ambitious project,” the OBOR involves over 65 countries, 62% of the world’s population, and a third of global Gross Domestic Product (GDP). The program is estimated to cost a total $5 trillion in infrastructural investments and it is said that China has already spent approximately $1 trillion. This makes the OBOR the biggest economic development program in history, easily overtaking America’s post-WWII Marshall Plan.

C. Sources of Funding

Given the OBOR’s massive price tag, it is funded through multiple institutions and parties. Firstly, the state-owned Silk Road Fund, launched in 2015 with an initial capital sum of $40 billion, in addition to the China Development Bank and the Export and Import Bank of China, represent China’s domestic sources of funding. These are supplemented by two multilateral institutions led by China: the Asian Infrastructure Investment Bank (with a registered capital of $100 billion) and the New Development Bank (with an initial capital sum of $50 billion).

II. Strategic Implications

The strategic implications of the OBOR fall into two main categories: economic and geopolitical. While examining the former category allows one to understand the domestic and international implications of the OBOR’s economic aspects, the latter sheds light on the shifting international balance of power dynamics the OBOR entails. It is important to note that these two categories share a symbiotic relationship. The OBOR’s economic ambitions will allow China the leverage it needs to realize its geopolitical vision. Similarly, China’s status as a global superpower will allow it to sustain its economic order much in the same way the US has leveraged its position of power to maintain its liberal economic order.

Increased Internationalization

If successful, the OBOR could be the solution to China’s economic problems, which once solved would allow China’s economy to further extend its lead over the US economy once it surpasses it. Specifically, China has in recent years suffered from widespread overcapacity in heavy industries such as steel, cement, and aluminium.Through the OBOR, China is looking to “ship its own domestic overproduction offshore.” In addition to the billions of dollars in infrastructural investment China will make as it puts its industrial overcapacity to work, the OBOR will allow China to open up new markets for its goods, further fueling its export-driven growth strategy. Through the OBOR, China seeks to not just surpass the US economy in size but also to reshape the international economic order in fundamental ways. For example, the use of China-dominated multilateral financial institutions to fund the OBOR is an important step towards promoting the RMB as an alternative to the USD. Indeed, the AIIB’s initial $100 billion will be increased many times over in the coming years, signaling China’s desire to reduce its reliance on the USD and internationalize its own currency. Finally, by investing in overseas infrastructure, China hopes to make better use of its vast foreign-exchange reserves, most of which presently take the form of low-interest US Treasury Bills. For example, China is funding 75% of an infrastructural project that will “build a 142km high-speed rail linking Jakarta with Bandung.” An important implication of these investments is the economic leverage this awards China if it chooses to pursue its hegemonic ambitions in the future. All in all, the economic impact of China’s OBOR not only allows it to enhance and sustain its economic growth, it also effectively primes China for a greater role in global affairs.

The Rise of a Geopolitical Giant

For all of its impressive aims and ambitions regarding economic expansion, China’s OBOR is ultimately a powerful foreign policy tool, one which reveals telling glimpses of China’s vision of globalization and the future of the global international order. While several Western analysts have likened the OBOR to the post-WWII Marshall Plan, which essentially laid the foundations for America’s liberal economic order and hegemony, China has vehemently denied such hegemonic ambitions. Instead, China insists its vision for globalization and the world economic order is a “multipolar” and “pluralist” one. This officially touted intention of establishing an “open and inclusive (international) platform” is perhaps consistent with China’s insistence on its “peaceful rise” and rejection of establishing unipolar hegemony. In any case, while China may or may not strive to lead the future global economic order, it certainly aims to be at its center of gravity. In the realm of geopolitics, China has yet to truly demonstrate hegemonic ambitions, though its increasingly assertive island-building campaign in the South China Sea is particularly troubling. In the meantime, China has signaled its economic intentions with the OBOR, a project that consolidates and formalizes its rapidly growing economic clout while indicating its desire to take on a more active role in global affairs. The economic and geopolitical rise of China, which has essentially been formalized by its OBOR initiative, coincides with the US’ steady retreat from its position of global leadership as President Trump pursues his inward-looking America First Policy. While China has steadily endeavored to execute its OBOR initiative, the US has pulled out of the Trans-Pacific Partnership. In the geopolitical contest presently being waged in Asia, the TPP represented America’s most potent means of combating China’s strategic economic position in East Asia. By withdrawing from it, the US fails to offer regional countries a viable alternative for regional trade and investment. Indeed, experts warn that President Trump’s withdrawal from the TPP leaves an economic and geopolitical void that China may soon fill.

III. Concluding Remarks

The extent to which China’s OBOR can be truly regarded as the harbinger of a new global economic order depends on whether President Xi and the CCP can appropriately modify their present strategy to address a considerable array of problems the OBOR has encountered. Experts like George Friedman, quoted earlier in the article, raise legitimate concerns about the OBOR’s viability and track record. Some projects, such as Line D of the Central Asia-China Pipeline, have simply stalled. Furthermore, China is facing backlash for certain projects, with “elected governments in Sri Lanka and Myanmar repudiating or seeking to renegotiate projects approved by their authoritarian predecessors.” Finally, European countries, in general, seem to be highly suspicious of the OBOR and have thus far abstained from participating in its rollout. The world would also do well to remember that China has, in recent times, shown a knack for achieving incredible economic feats. Due to the extensive reforms that were undertaken by Deng Xiaoping, China has embarked on an unstoppable export-oriented growth miracle that continues to this day. Likewise, Xi has launched his own ambitious economic project. One could say that Deng’s legacy was implementing the vital reforms needed for China to achieve monumental economic growth. In the same vein, Xi’s legacy could very well be the OBOR.